Ira withdrawal tax calculator

Starting the year you turn age 70-12. Updated for 2022 Use our required minimum distribution RMD calculator to determine how much money you need to take out of your traditional IRA or 401 k account this year.

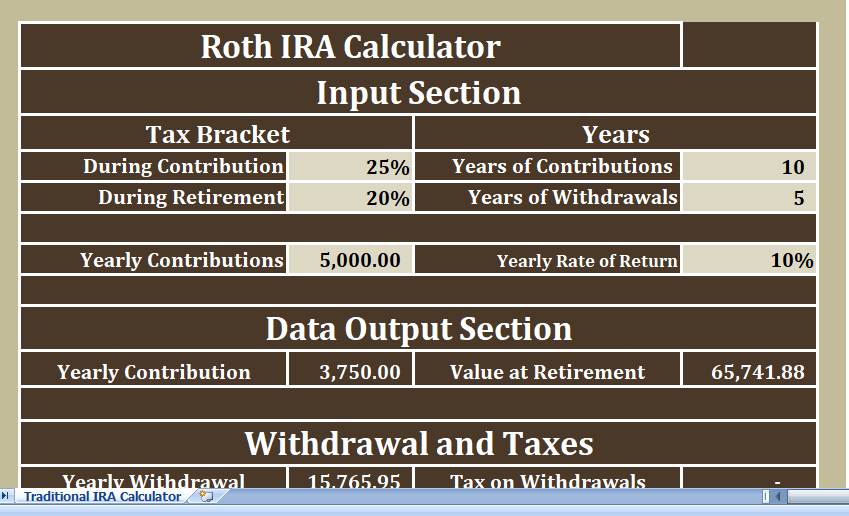

Roth Ira Calculator Roth Ira Contribution

Use our traditional IRA calculator to see how much your nest egg will grow by the time you reach retirement.

. With a traditional IRA withdrawals are taxed as regular income not capital gains based on your tax bracket the year of the withdrawal. Account balance as of December 31 2021. Traditional IRA Calculator Details To get the most benefit from this.

That is it will show which amounts will be subject to ordinary income tax andor. 6 1 There are currently seven federal. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

State income tax rate 0 7 13 20 Withdrawing 1000 leaves you with 610 after taxes and penalties Retirement Plan Withdrawal Calculator Definitions Amount to withdraw The. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from.

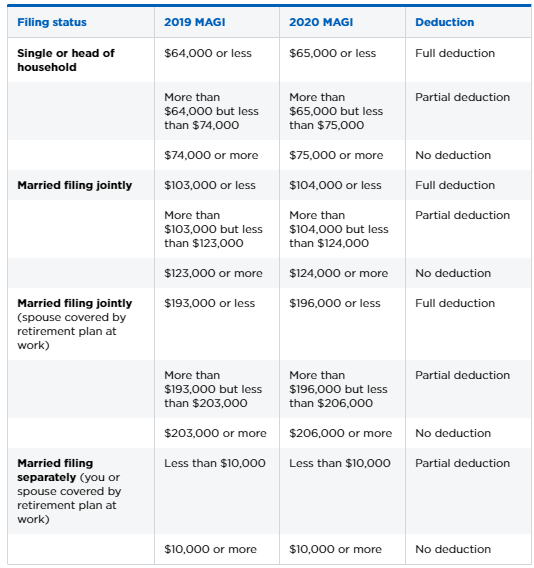

Find a Dedicated Financial Advisor Now. Ad Make a Thoughtful Decision For Your Retirement. Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

Roth IRA Distribution Tool. You can use Internal Revenue Service tax tables or an online calculator tool to figure out what tax bracket youre in and estimate how much tax youll pay on a particular IRA. This tool is intended to show the tax treatment of distributions from a Roth IRA.

More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Calculate your earnings and more. Find a Dedicated Financial Advisor Now.

Decide how to receive your RMD. Do Your Investments Align with Your Goals. Do Your Investments Align with Your Goals.

Since you took the withdrawal before you reached age 59 12 unless you met. Regardless of your age you will need to file a Form 1040 and show the amount of the IRA withdrawal. Build Your Future With a Firm that has 85 Years of Retirement Experience.

Your life expectancy factor is taken from the IRS. Calculate the required minimum distribution from an inherited IRA. While long-term savings in a Roth IRA may.

IRA Beneficiary Calculator Beneficiary Required Minimum Distribution Calculate your earnings and more When you are the beneficiary of a retirement plan specific IRS rules regulate the. Ad A Traditional IRA May Be an Excellent Alternative if You Qualify for the Tax Deduction. You can make a one-time also known as lump-sum withdrawal or a series of withdrawals or schedule automatic withdrawals.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. You can find an IRA withdrawal penalty calculator or simply multiple the taxable amount by 010 to calculate the penalty. Ad We Reviewed the 10 Best Gold IRA Companies For You to Protect Yourself From Inflation.

Use AARPs Traditional IRA Calculatorto Know How Much You Can Contribute Annually. How is my RMD calculated. 2018 Tax Brackets The Tax Cuts and Jobs Act.

The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from your retirement accounts annually.

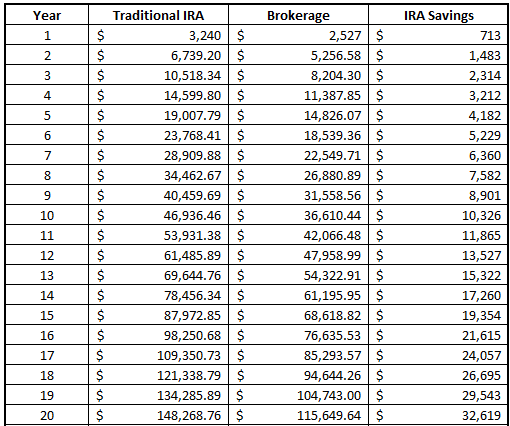

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Federal Income Tax Templates Archives Msofficegeek

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Download Free Traditional Ira Calculator In Excel

Download Traditional Ira Calculator Excel Template Exceldatapro

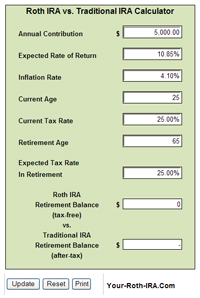

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Traditional Vs Roth Ira Calculator

Best Roth Ira Calculators

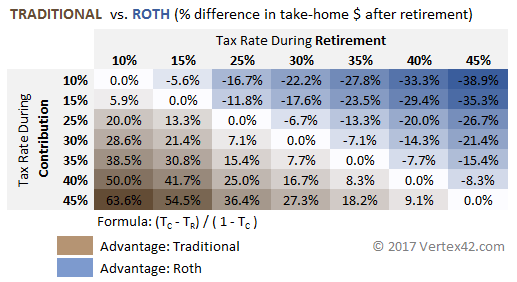

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Traditional Vs Roth Ira Calculator

Ready To Use Traditional Ira Calculator 2021 Msofficegeek

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Download Traditional Ira Calculator Excel Template Exceldatapro

Retirement Withdrawal Calculator For Excel

Roth Ira Calculator Excel Template For Free