Simple depreciation calculator

First one can choose the. This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods.

Depreciation Formula Calculate Depreciation Expense

D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation.

. The MACRS Depreciation Calculator uses the following basic formula. Depreciation Calculator This depreciation calculator is for calculating the depreciation schedule of an asset. The calculator also estimates the first year and the total vehicle depreciation.

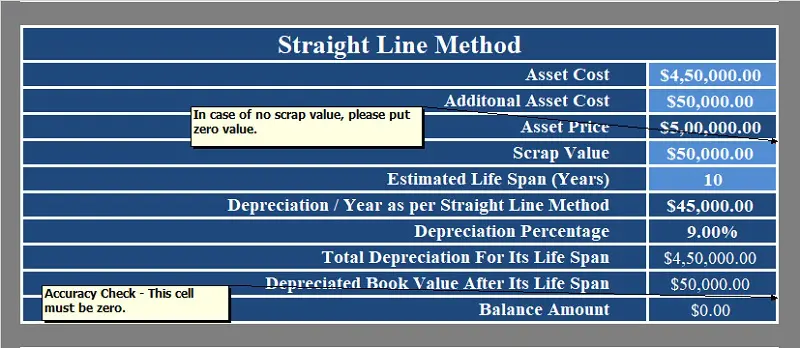

Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae. Hence it is given the name as the diminishing balance method Depreciation Calculator Excel Template. Depreciation calculations are made for both regular tax and alternative minimum tax AMT purposes.

It calculates the new depreciation based on that lower value. Rental property depreciation calculator. After two years your cars value.

After a year your cars value decreases to 81 of the initial value. Fixed Declining Balance Depreciation Calculator Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of. The calculator allows you to use.

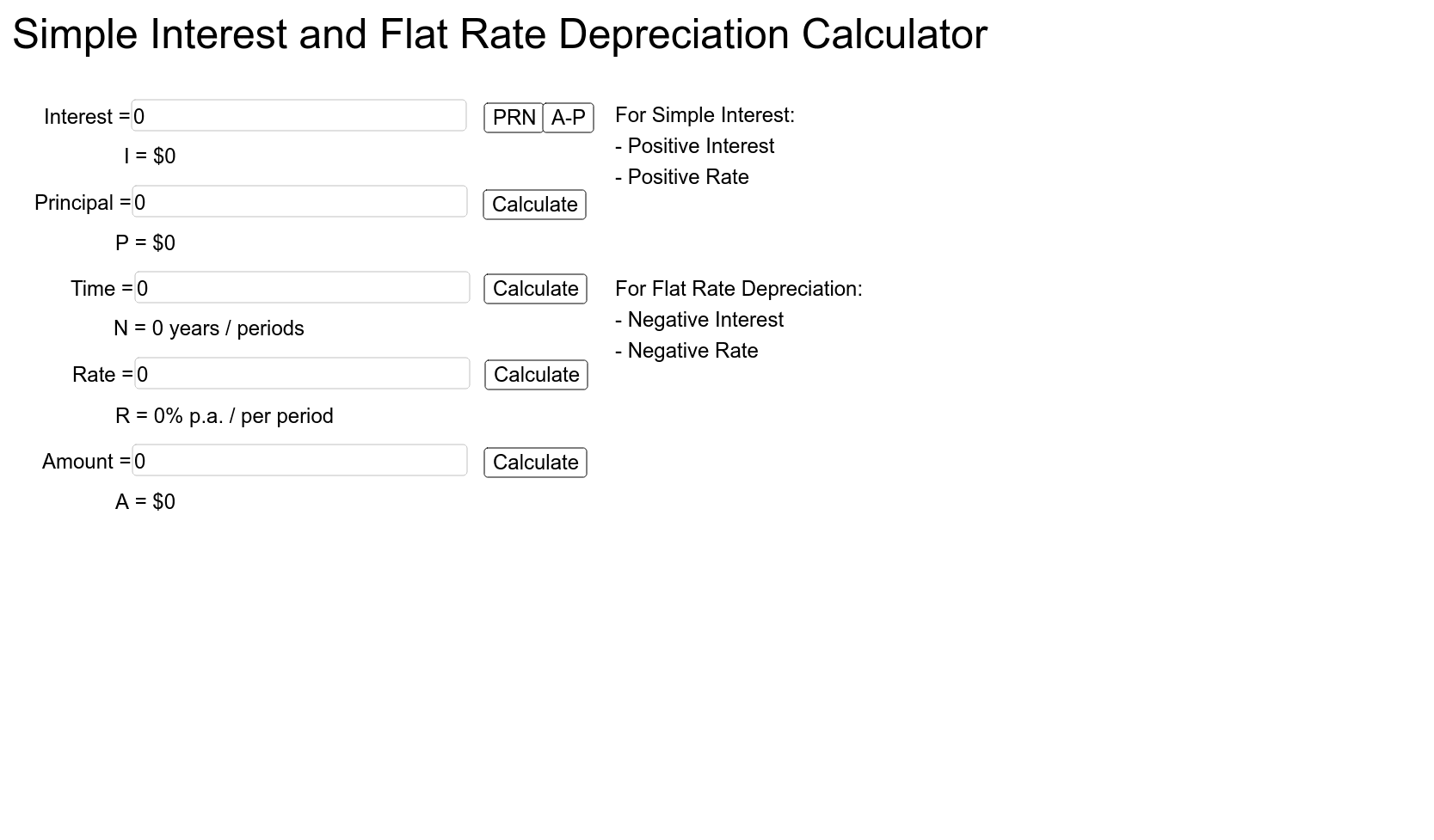

How Simple Interest Works In This Calculator Simple growth 10 of 100 10 has to be added on each period. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures. We have created a.

Example Start value 100 Rate of Interest 5 Period 5 years For 1 year. Depreciation Amount Asset Value x Annual Percentage Balance. It provides a couple different methods of depreciation.

The following depreciation methods are supported for GAAP financial statement. Non-ACRS Rules Introduces Basic Concepts of Depreciation. Business vehicle depreciation calculator.

Calculator for depreciation at a declining balance factor of 2 200 of. This Car Depreciation Calculator allows you to estimate how much your car will be worth after a number of years. Know at a glance your balance and interest payments on any loan with this simple loan calculator in Excel.

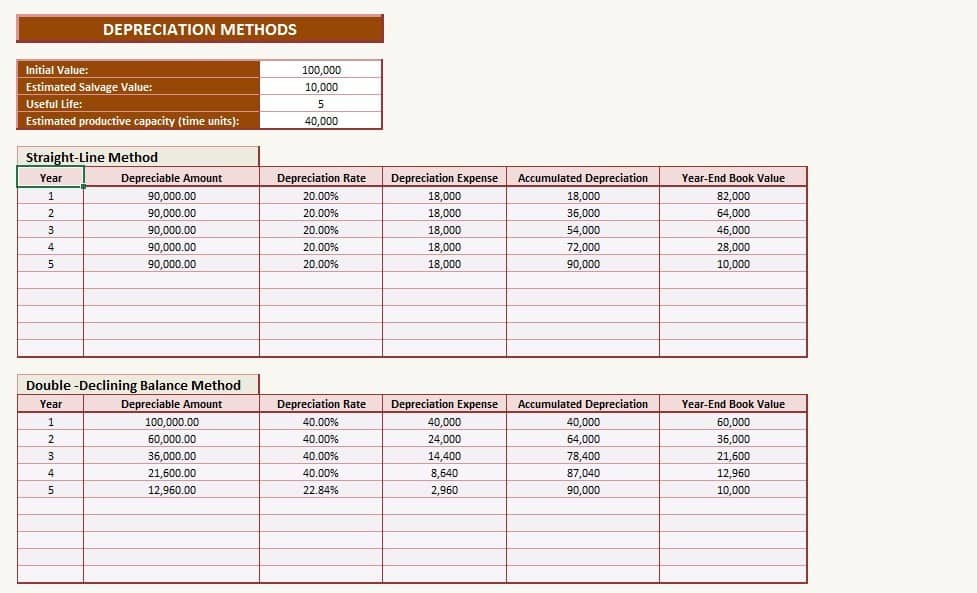

Our car depreciation calculator uses the following values source. Calculate depreciation of an asset using the double declining balance method and create a depreciation schedule. Simple Interest Calculator Annualized Return Calculator.

Just enter the loan amount interest rate loan duration and start date into the Excel. Depreciation calculator helps you to find depreciation on the car rental property and vehicle with a depreciation rate and formula. Straight line depreciation calculator.

Depreciation Formula Calculate Depreciation Expense

Macrs Depreciation Calculator With Formula Nerd Counter

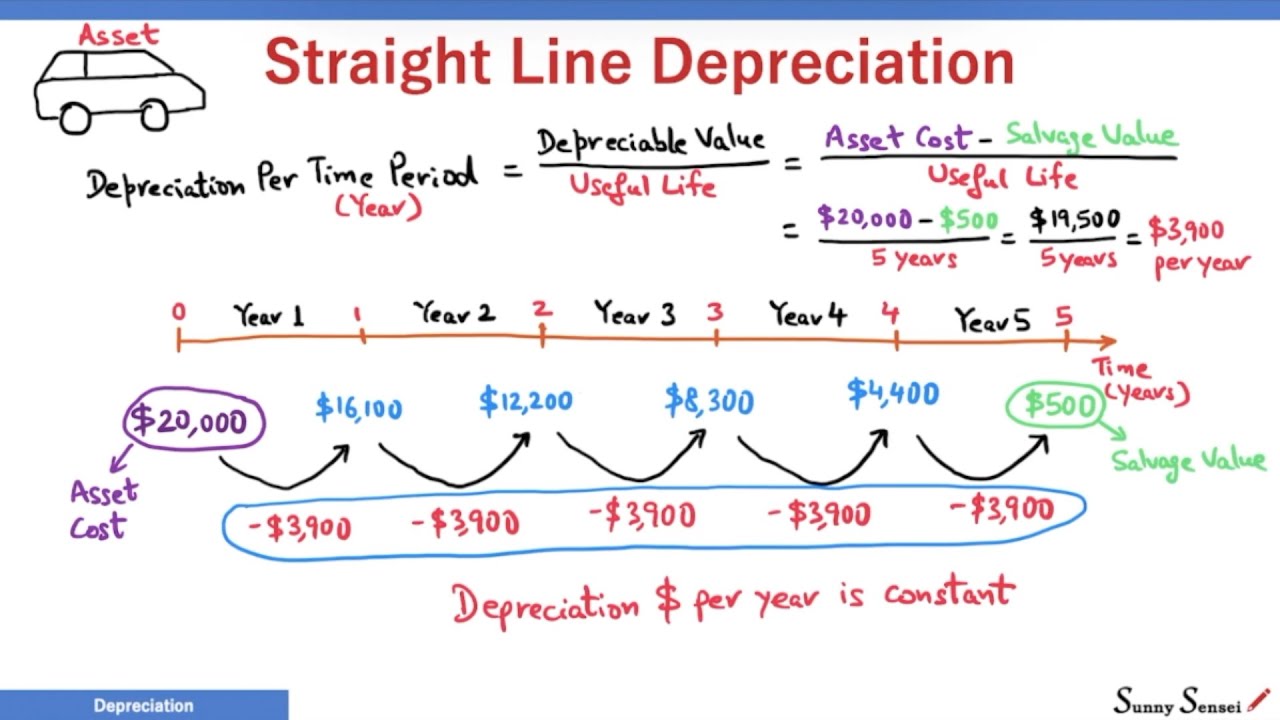

Straight Line Depreciation Formula Guide To Calculate Depreciation

Depreciation Formula Examples With Excel Template

Declining Balance Depreciation Double Entry Bookkeeping

Simple Interest And Flat Rate Depreciation Calculator Geogebra

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Depreciation Formula Examples With Excel Template

Straight Line Depreciation Formula And Calculation Excel Template

Depreciation Formula Calculate Depreciation Expense

Download Depreciation Calculator Excel Template Exceldatapro

Depreciation Rate Formula Examples How To Calculate

Depreciation Calculator

Free Macrs Depreciation Calculator For Excel

Method To Get Straight Line Depreciation Formula Bench Accounting

1 Free Straight Line Depreciation Calculator Embroker

Sum Of Years Digits Depreciation Concept Formulas Solved Problem Pmp Exam Youtube